Dive into the dynamic world of RRSPs and TFSAs in Canadian financial planning! Discover strategies for optimal results, balance contributions, and craft a personalized financial blueprint. Ready to secure your financial future?

Read MoreUnlock financial freedom with Tax-Free Savings Accounts (TFSAs) in Canada! Dive into the versatile world of tax-free growth, contribution flexibility, and strategic planning. Your key to wealth empowerment and flexibility awaits!

Read MoreIn the dynamic landscape of Canadian retirement planning, understanding the intricacies of Registered Retirement Savings Plans (RRSPs) is key to unlocking financial freedom. Dive deep into the core of RRSPs, exploring their tax advantages, contribution limits, and the wealth-building potential they offer. Discover the power of tax-deferred contributions and growth, strategic withdrawal planning, and the long-term benefits that may make RRSPs a cornerstone in securing your golden years.

Read MoreRetirement planning in Canada is more than just a financial task; it's a strategic move towards securing a fulfilling future. In a landscape that boasts a robust retirement system, including the Canada Pension Plan (CPP) and Old Age Security (OAS), personal retirement planning emerges as the linchpin for crafting a retirement that aligns with individual aspirations.

Read MoreBuying a house is a very important decision. Becoming a homeowner means that you’re taking a big step on the path of financial stability, and you’ll want to be prepared for this step.

Read MoreCreating a positive mindset and thinking about the positives in life is paramount to “The Secret” working.

Read MoreGet excited when the stock market is tanking. Keep your eyes open and you’ll find some great investments at great prices.

Read MoreHome improvement projects don't have to be big or costly. Quick, inexpensive touchups can make a considerable impact on the look and value of your home.

Read MoreWhen you’re self-employed, there’s rarely time to waste. If money is tight, these may be challenging activities.

Read MoreAnswering the question of whether to pay off your mortgage early takes some deliberation

Read MoreAttempting to time the market is a mistake. Short-term investing strategies create too many missed opportunities and incur too many costs, including taxes.

Read MoreYour Golden Years can be the best time of your life. Plan for retirement wisely to ensure you have the money you desire in order to do what you want. And the best way to accumulate that money with less effort on your part is to start now – while you’re still young.

Read MoreThe decisions you make now have a tremendous amount of influence over your future.

Read MoreIn a world with seemingly unlimited insurance opportunities, there are times when it makes sense to drop certain policies and use the money for other purposes. Sometimes dropping your insurance is the financially responsible thing to do.

Read MoreChildren pick up money habits quickly, so giving them the right direction is crucial.

Read MoreThere are many financial rules we’ve all heard over and over again. But many of these rules aren’t perfect or don’t apply to every person’s individual situation. Instead of blindly following rules that someone else made, take the opportunity to consider a few counter arguments.

Read MoreIt is possible to purchase the kind of coverage you need, protect your vehicle, and save money if you take the time to shop around and select the right provider and policy.

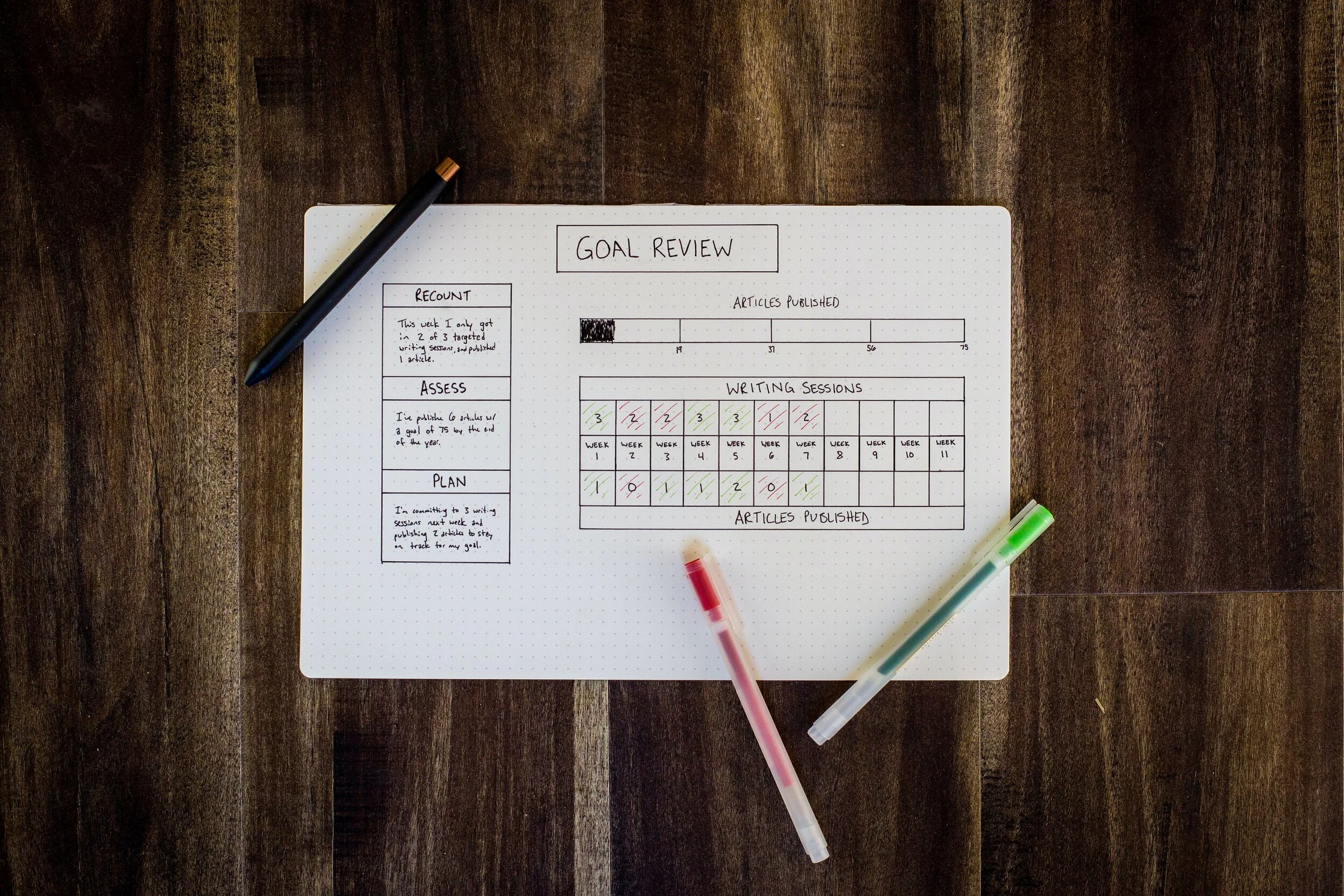

Read MoreOne of the most important keys to living a fulfilling life is to know where you're going. Having goals that motivate you, excite you, and push you forward can help you get the most out of yourself and experience a life that's worth living

Read MoreIs it true that a good life insurance agent is hard to find?

Read MoreSticking to your New Year’s resolutions will help lead 2022 to one of your most inspiring years ever!

Read More